Main Office: 650.377.4108

1850 Gateway Drive, Suite 350

San Mateo, CA 94404

While current obligations and financial emergencies may make it hard to prioritize savings at certain points in our lives, many people put off saving for retirement (or any other need) not because they cannot afford it, but because they are overwhelmed with the options and terminology. Putting off saving can have compounding effects, not only because it’s easy for days to become weeks, then years and even decades, but because the effects of reinvested earnings mean that, by retirement age, a dollar invested at 25 will grow more than one invested at 35 and far more than one invested at 45 or 55.

In this article in our “Savings 101” series, we will address the questions that many have regarding different types of retirement accounts, and the tax rules that surround them.

Most people have heard of IRAs and have at least some idea of what they are. They may have heard generic advice to “invest in a Roth IRA” as a savings strategy, but may not know what a Roth is (and may not know where to find out or be afraid to ask).

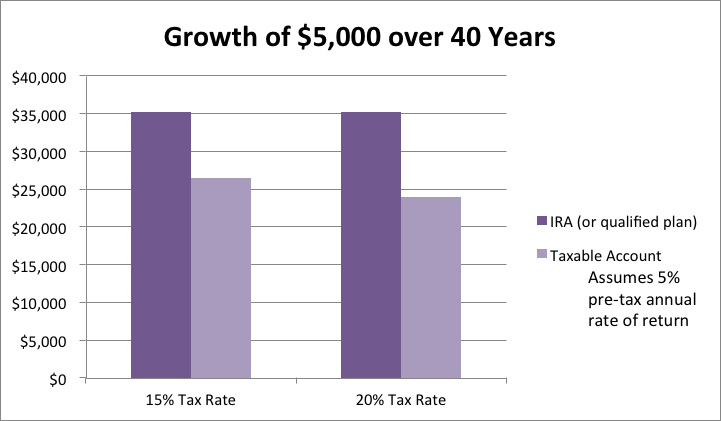

A traditional IRA, like a traditional 401(k), is a tax-deferred savings vehicle. What that means is that the money invested into these accounts is not included in your taxable income in the year that it is invested . If a 25 year old saver contributes $5,000 into a deductible IRA, that $5,000 is deducted from income on his or her tax return. Once invested, the $5,000 can grow free of any income or capital gains taxes. If the money is left alone for 40 years and earns a moderate rate of return of 5% per year, it would grow to over $35,000 by age 65. Depending on the type of investments in the account and the worker’s overall income, this tax benefit can turn out to be very powerful, as seen by the chart below.

For a traditional IRA, the only taxation that occurs is when money is taken out of the account. Upon retiring, many people’s income drops significantly, meaning IRA withdrawals are then taxed at a lower marginal income tax rate than the contributions or earnings would have been taxed at during their working years. In fact, the IRS’s intention is that this money not be taken until retirement and, in addition to taxes, there is a 10% early withdrawal penalty on distributions taken prior to 59 ½.

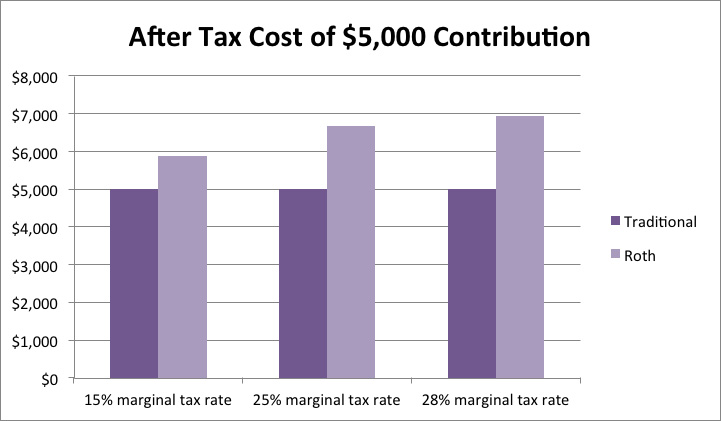

Think of a Roth IRA as a “backwards” IRA. Money put into a Roth IRA (or a Roth 401(k)) is taxed as income in the year that it is earned. As with a traditional IRA, there is no tax on earnings or capital gains as long as the money remains in the account. When an individual takes a distribution from a Roth account, that money is not taxed if they meet certain conditions . Roth contributions are more expensive in current-day dollars since they are not tax-deductible – they will reduce your budget by both the contributed amount AND the tax paid on it.

One reason Roths are frequently recommended for young workers and new savers is because if you are in a low tax bracket now, the current deduction is worth less. As illustrated in the below chart, someone who is in the 28% tax bracket will need to earn close to $7,000 before taxes in order to make $5,000 available for a Roth contribution whereas for a taxpayer in the 15% bracket, the same contribution will only cost about $5,900 in pre-tax dollars. For those subject to high state income taxes, the effect is even larger.

Which type of contribution is better for you is going to be an individualized question which a financial planner can help you determine, but either is going to be better down the road than not getting started. This is doubly true in an employer plan where the employer matches contributions.

For those who have access to them through their work, employer-sponsored retirement plans can be a great way to start saving. The money is automatically deducted from your paycheck and is generally free from state and federal income taxes. Because a traditional 401(k) (or other qualified plan) contribution comes out before income taxes, the effect on take-home pay ends up being less than the amount deposited into the plan. For example if you contribute $100 to your 401(k) and would otherwise have 30% withheld for income taxes, the contribution will only end up reducing your paycheck by $70.

Many employers offer a match contribution to those who participate in their plan. This match is generally expressed as some percentage of annual salary, such as 3% or 6%. A 100% or dollar-for-dollar match up to the given limit means that for every dollar an employee contributes up to that limit, the employer will contribute the same amount. Matches may also be at a ratio such as $0.50 per dollar, meaning that for every dollar the employee contributes, the employer will contribute fifty cents – thus if an employer matches up to 6% but only at a $0.50-per-dollar (or 50%) rate, an employee contributing 6% would also receive a match contribution valued at 3% of their annual compensation.

Employer contributions may be subject to a vesting schedule, meaning that if the employee leaves the employer before a set period of time (generally 3-5 years) has passed, part or all of the employer contribution will be forfeited. It is important to note that an employee’s OWN contributions are NEVER subject to a vesting schedule and can always be withdrawn or rolled over after separating from service.

Employer-sponsored plans have higher annual contribution limits than IRA’s and unlike IRA contributions there is not an income limitation. For those who receive a match, failing to contribute up to the match limit is leaving additional compensation on the table and for those in high tax brackets, the effect of a maximum contribution ($19,000 in 2016 with an additional $6,000 catch-up for those 50 and older) can be a major benefit.

If you expect to be in a higher tax bracket during retirement, a Roth 401(k) may be a good option, if it is available through your employer. These are becoming more common, though it is important to remember that a Roth contribution will reduce your paycheck more than a Traditional 401(k) contribution of the same amount. Given the impact of reinvested returns over many years, for those who cannot afford to save a lot, it may be better to go with a larger Traditional 401(k) contribution instead.

As with IRA distributions, in return for the tax breaks, IRS rules make it difficult to access these funds prior to retirement. Many plans allow loans and hardship withdrawals to provide some access to the account, but generally withdrawals cannot be made until retirement age or separation from service. As with IRA’s, money withdrawn (other than rollovers) prior to 59 ½ may be subject to both taxes and a 10% early withdrawal penalty.

Although there are a number of rules that can make IRA’s and employer-sponsored plans seem intimidating to those who have not yet gotten started, once you set up a regular contribution, letting it grow over time can provide tremendous benefits. Even if you only have a little bit to save for the long term, putting away a small amount per paycheck on a tax-advantaged basis now can leave future you with a lot more than you started with.

1 For those who participate in a retirement plan at work (or who have spouses who do), the deductibility of IRA contributions is phased out at higher income levels.

2 Must be over 59 ½ and have had the Roth IRA for at least five years in order to withdraw earnings without generating taxes. The original contribution amount, since it came from money that had already been taxed, is not taxed when distributed.

3 Roth contributions are phased out for single taxpayers with AGI from $122,000-$137,000 and married taxpayers with AGI from $193,000-$203,000. These limits are indexed to inflation.

4 Certain withdrawals may qualify for an exception to the 10% penalty, such as those for death, disability, or for those who are separated from service during or after the year they turn 55.

Robin Starr is a registered representative of Lincoln Financial Advisors Corp. Branch address 1510 Fashion Island Blvd, Ste 210 San Mateo, CA. Branch phone number 650-377-4108.

Securities and investment advisory services offered through Lincoln Financial Advisors, a broker-dealer (member SIPC) and registered investment advisor. Insurance offered through Lincoln Marketing and Insurance Agency, LLC and Lincoln Associates Insurance Agency, Inc. and other fine companies. Athena Wealth Strategies is not an affiliate of Lincoln Financial Advisors Corp. CRN2365349-010319

We are licensed in the following states. If you are a legal resident of one of these states, please proceed. We are sorry if we are unable to offer you our services at this time.

Securities: Alabama, Arizona, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Indiana, Maryland, Massachusetts, Missouri, Montana, Nevada, New Jersey, New Mexico, New York, North Carolina, Oregon, Texas, Virginia, Washington, Washington D.C. and Utah.

Unless otherwise identified, Associates on this website are registered representatives of Lincoln Financial Advisors Corp. Securities and investment advisory services offered through Lincoln Financial Advisors Corp., a broker/dealer and a registered investment advisor. Member SIPC. Insurance offered through Lincoln affiliates and other fine companies and state variations thereof. In CA, insurance offered through Lincoln Marketing and Insurance Agency, LLC and Lincoln Associates Insurance Agency, Inc. and other fine companies. Lincoln Financial Group is the marketing name for Lincoln National Corporation and its affiliates. Firm disclosure information available at www.LFG.com. Athena Wealth Strategies is a marketing name for registered representatives and investment advisor representatives of Lincoln Financial Advisors. CRN2995395-031320

See Lincoln Financial Advisors (LFA’s) Form CRS Customer Relationship Summary, available here, for succinct information about the relationships and services LFA offers to retail investors, related fees and costs, specified conflicts of interest, standards of conduct, and disciplinary history, among other things. LFA’s Forms ADV, Part 2A, which describe LFA’s investment advisory services, Regulation Best Interest Disclosure Document, which describes LFA’s broker-dealer services, and other client disclosure documents can be found here.

Julie VanTilburg, CA Insurance License #0C21028; Maritza Rogers, CA Insurance License #0E50369; Robin Starr, CA Insurance License #0G64012; Jeffrey Better, CA Insurance License #0182274; Kaitlyn Zawada, CA Insurance License #4084200